A sample text widget

Etiam pulvinar consectetur dolor sed malesuada. Ut convallis

euismod dolor nec pretium. Nunc ut tristique massa.

Nam sodales mi vitae dolor ullamcorper et vulputate enim accumsan.

Morbi orci magna, tincidunt vitae molestie nec, molestie at mi. Nulla nulla lorem,

suscipit in posuere in, interdum non magna.

|

Even before the landmark United States v. Microsoft Corp. antitrust case, competition law was a bit schizophrenic when it came to the question of interoperability. Monopolists have no general duty to make their products work with those of competitors, but what about the situation where a dominant firm deliberately re-designs products to render them incompatible with others? That is the provocative question raised by several pending antitrust lawsuits filed against Green Mountain Coffee, manufacturer of the Keurig line of single-serve coffee makers and coffee “pod” products.

TreeHouse Foods alleged in a complaint last winter that after its patent on “K-Cups” expired in 2012, Green Mountain:

abused its dominance in the brewer market by coercing business partners at every level of the K-Cup distribution system to enter into anticompetitive agreements intended to unlawfully maintain Green Mountain’s monopoly over the markets in which K-Cups are sold. Even in the face of these exclusionary agreements that have unreasonably restrained competition, some companies, such as TreeHouse, have fought hard to win market share away from Green Mountain on the merits by offering innovative, quality products at substantially lower prices. In response, Green Mountain has announced a new anticompetitive plan to maintain its monopoly by redesigning its brewers to lock out competitors’ products. Such lock-out technology cannot be justified based on any purported consumer benefit, and Green Mountain itself has admitted that the lock-out technology is not essential for the new brewers’ function.

In the consolidated multi-district litigation that ensued, Green Mountain is specifically charged with designing a so-called “Keurig 2.0” brewer which features technology that allows it to detect whether a coffee cartridge is one of Keurig’s K-Cups or is made by a third party that does not have a licensing agreement with the company. The machine will not brew unlicensed coffee pods.

The federal court overseeing the MDL cases denied the plaintiffs’ motion for an injunction on procedural grounds in September, issuing an opinion which reasoned that commercial success of the “2.0” brewers was uncertain and that coffee competitors would still have open access to some 26 million Keurig “1.0” machines for several years. In other words, the court did not reach the merits of the monopolization claim against Green Mountain.

So where does that leave Keurig? As Ali Sternburg observed before revelations of its new 2.0 technology, Green Mountain’s prior 20 years of patent protection allowed the company to build a competitive advantage by “cultivating its brand (which likely involves trademark protection), honing its supply chain efficiencies, and generally maintaining its dominance due to having the first-mover advantage.” More than ten years before those patents first issued, moreover, the federal courts had ruled that new product introductions by monopoly firms — in one well-known instance, Kodak — would not be considered an antitrust violation because “a firm that pioneers new technology will often introduce the first of a new product type along with related, ancillary products that can only be utilized effectively with the newly developed technology.”

Continue reading K-Cups, Innovation and Interoperability

No one in government or business has a crystal ball. Yet predictions of what is coming in markets characterized by rapid and disruptive innovation seem to be being made more often by competition enforcement agencies these days than in the past. It’s a trend that raises troublesome issues about the role of antitrust law and policy in shaping the future of competition.

Take two examples. The first is Nielsen’s $1.3 billion merger with Arbitron this fall. Nielsen specializes in television ratings, less well-known Arbitron principally in radio and “second screen” TV. Nonetheless, the Federal Trade Commission — by a divided 2-1 vote — concluded that if consummated, the acquisition might lessen competition in the market for “national syndicated cross-platform measurement services.” The consent decree settlement dictates that the post-merger firm sell and license, for at least eight years, certain Arbitron assets used to develop cross-platform audience measurement services to an FTC-approved buyer and take steps designed to ensure the success of the acquirer as a viable competitor.

In announcing the decree, FTC chair Edith Ramirez noted that “Effective merger enforcement requires that we look carefully at likely competitive effects that may be just around the corner.” That’s right, and the underlying antitrust law (Section 7 of the Clayton Act) has properly been described as an “incipiency” statute designed to nip monopolies and anticompetitive market structure in the bud before they can ripen into reality. Nonetheless, the difference is that making a predictive judgment about future competition in an existing market is different from predicting that in the future new markets will emerge. No one actually offers the advertising Nirvana of cross-platform audience measurement today. Nor is it clear that the future of measurement services will rely at all on legacy technologies (such as Nielsen’s viewer logs) in charting audiences for radically different content like streaming “over the top” television programming.

The problem is that divining the future of competition even in extant but emerging markets (“nascent” markets) is extraordinarily uncertain and difficult. That’s why successful entrepreneurs and venture capitalists make the big bucks, for seeing the future in a way others do not. That sort of vision is not something in which policy makers and courts have any comparative expertise, however. Where the analysis is ex post, things are different. In the Microsoft monopolization cases, for instance, the question was not predicting whether Netscape and its then-revolutionary Web browser would offer a cross-platform programming functionality to threaten the Windows desktop monopoly — it already had — but rather whether Microsoft abused its power to eliminate such cross-platform competition because of the potential long-term threat it posed. By contrast, in the Nielsen-Arbitron deal, the government is operating in the ex ante world in which the market it is concerned about, as well as the firms in and future entrants into that market, have yet to be seen at all.

This qualitative difference between nascent markets and future markets (not futures markets, which hedge the future value of existing products based on supply, demand and time value of money) is important for the Schumpterian process of creative destruction. When businesses are looking to remain relevant as technology and usage changes, they are betting with their own money. The right projection will yield a higher return on investment than bad predictions. Creating new products and services to meet unsatisfied demand may represent an inflection point, “tipping” the new market to the first mover, but it may also represent the 21st century’s Edsel or New Coke, i.e., a market that either never materializes or that develops very differently from what was at first imagined.

Continue reading Future Markets, Nascent Markets and Competitive Predictions

A few weeks ago, the head of competition for the European Union, Joaquin Almunia, reportedly instructed Google that the search giant must make “sweeping changes” to its business model by extending restrictions the Europeans are insisting upon for Web search into the mobile realm. (See EU Orders Google to Change Mobile Services | Reuters.)

Is he possibly for real? We all know mobile is growing by leaps and bounds, powering political revolutions, connecting the developing world to the new information economy, and disrupting legacy industries. That market dynamism should instead counsel for a restrained approach, delaying government intervention until at least some of the dust settles, because mobile is different. Here’s why — and how that matters.

1. Apps Rule Mobile, Not Web Search

With more than 300,000 mobile applications released in the last year alone, “apps are increasingly replacing browsers as the method of choice for connected consumers to find and use information.”  This striking user preference is neither difficult to discern nor hard to understand. One can see it walking on nearly any downtown street as teenagers query Foursquare and Facebook apps for friend check-ins, businessmen find lunch spots with OpenTable or Yelp, and 20-somethings search for trending hashtag topics inside Twitter’s app. In other words, in the mobile realm apps rule. This striking user preference is neither difficult to discern nor hard to understand. One can see it walking on nearly any downtown street as teenagers query Foursquare and Facebook apps for friend check-ins, businessmen find lunch spots with OpenTable or Yelp, and 20-somethings search for trending hashtag topics inside Twitter’s app. In other words, in the mobile realm apps rule.

Wired’s editor-in-chief Chris Anderson in 2010, along with Square’s COO Keith Rabois in 2011, both predicted flatly that the Web is dying and mobile devices with dedicated apps are to blame. Apple’s Steve Jobs (watch his keynote) said it a bit more provocatively:

On a mobile device, search hasn’t happened. Search is not where it’s at. People aren’t searching on a mobile device like they do on the desktop. What is happening is they are spending all of their time in apps.

The numbers now prove that all three of these pundits were correct. As much as 50% of mobile search is happening in apps today. In March, a remarkably small 18.5% of all smartphone and tablet usage was in the browser; the rest was through apps. Nearly half of smartphone owners today shop using mobile apps. The international wireless association GSMA reported as far back as 2011 that second only to texting (and even more than actual calls), native apps comprise the highest level of smartphone activity. Yelp’s CEO Jeremy Stoppelman told Wall Street on August 2 that a majority of weekend searches now come in through its mobile app and that “by choosing the Yelp app people are bypassing search engines and consequently their engagement is higher.” Even venerable Craigslist is today battling mobile apps.

So mobile Web search is either dead or dying. That’s in part, as explained in the next bullet, because mobile users need, want and expect immediate answers, not a listing of URLs for browsing. Blue links just do not cut it anymore when users are mobile.

2. Search Is Local, Targeted and Interactive For Mobile Users

CNN Mobile’s VP Louis Gump, a mobile legend, says that every business must “start with the assumption that mobile is different.” Reflecting that difference, mobile sites typically include only the most crucial and time- and location-specific functions and features, while desktop Web sites contain a wide range of content and information. The reason is that mobile users are looking for local, immediate and interactive information.

Consider these stats —

-

Somewhere from 40% to 53% of all mobile searches are local. Coupled with GPS location detection, mobile users employ their devices to navigate and explore the world around them. Coffee anyone?

-

-

Our “information needs and habits” are different on mobile, reports TechCrunch, where users want “smaller bits of information quicker, usually calibrated to location.” The end result is a relationship between device owner and information which is far more personal, immediate and reciprocal in the mobile environment than on the desktop. Marketers know this and are working feverishly to engage their audiences using these new selling points. Mobile marketing is “immediate, personal and targeted to specific consumer groups” says Twitter marketing rockstar Shelly Kramer.

3. Voice As the Mobile UI Is a Game Changer

Along with everything from in-car services like Ford’s Microsoft-powered Sync and even TV remote controls, mobile UIs are evolving rapidly to offer the consistency that made the graphical UI (GUI) so important in evolution of the desktop PC. But in the mobile environment, voice is becoming the always-available common denominator as the size of devices and the desire (and legal need) for hands-free use limit the effectiveness even of touchscreens.

Using market leader Apple as our example again, as Frank Reed commented in Marketing Pilgrim,

Siri is definitely a form of search. It’s a request and answer mechanism that can do tasks outside of search (texts, emails, etc.) but when a user asks it for the closest Italian restaurant it is, in essence, a search engine. It is presenting what its backend calculations have decided are the best possible answers for the question asked by the iPhone user. Sounds exactly like Google’s function as a search engine, doesn’t it? Different delivery of a result set but it’s search.

Android users have a similar capability with Google Now, which has been called “more than just a new voice search application for Android; it’s also an indication of how Google will overhaul the user interface for its search products.” Consumers will soon see this same sort of voice interaction in mobile apps (powered by Nuance and others), on Windows phones and from well-funded voice search venture AskZiggy.

Voice is “the most revolutionary user interface in the history of technology,” according to Forbes. And it is all about search: search on steroids that is. As far as Google, the Mountain View company countered with a just-announced voice search app for the Apple iOS and interactive search results on its mobile Web properties. Whether Google can recapture the inventiveness in voice and mobile search that allowed its Web algorithms to dominate is open to serious question. Right now it’s rather desperately playing catch-up.

4. No One Has Yet Figured Out How To Monetize Mobile

Look closely at that graphic. Notice the dramatic difference between advertising spending and usage rates on mobile platforms compared to other media? That’s because no one has really figured out yet how to monetize mobile services. Social media darling Facebook — illustrated painfully by its revenue and stock price stumbles — for years has stood as the dominant supplier of display ads on the Web, but has just barely tried to introduce advertising into its mobile app. Considering that in May total usage of Facebook mobile surpassed that of its classic website for the first time and the clear lesson is that profiting from mobile information is a difficult endeavor, lagging well behind most technology markets.

Other than wireless network carriers, that is. As The Economist explains:

The [mobile] combination of personalisation, location and a willingness to pay makes all kinds of new business models possible….. Would-be providers of mobile Internet services cannot simply set up their servers and wait for the money to roll in, however, because the network operators — who know who and where the users are and control the billing system — hold all the cards.

This is not the place to discuss data caps and shared wireless plans, but the fact is that few if any mobile Internet services except those employing a pay-per-subscriber model have even come close to monetizing the mobile experience. That will and must change, although when and how remain unclear. As BusinessWeek notes, “desktop Internet use led to the rise of Google, eBay and Yahoo, but the mobile winners are still emerging.”

5. Mobile FIRST Is The New Reality

Ten, five or even two years ago, developers all talked about the need to adapt content to fit the smaller form factor, screen real estate and touch navigation features of mobile devices. That’s already ancient history today. The new reality is that everyone from television and media companies to PC manufacturers are thinking “mobile first,” designing interfaces (gesture-based and voice-powered), content (shorter, punchier and more micro blog-like) and interactivity (social media integration, video clip streams, etc.) to cater to an audience that is dominantly mobile, most of the time.

The title of Luke Wroblewski’s new book Mobile First says it all. In a mobile world, all we thought we had learned about the Web is reversed and upside down. Mobile starts from scratch and leads everything else.

So how do these profound differences matter? This author (and my Project DisCo colleague Dan O’Connor) has previously written about the difficulties of “market definition” in search, a big term for the simple idea that display ads, text ads and organic search results are all competing for the same customers. If the Federal Trade Commission (FTC), which is still “investigating” Google for alleged search monopolization two years on, took this into account, its lawyers would scuttle any government prosecution because Google’s market share would be well below that of search alone, hardly in monopoly territory.

Earlier DisCo commented about the European Union’s penchant for regulating nascent products and industries before they even exist. By moving against Google in mobile Web search, the EU is instead trying to regulate a market that is dying and all but irrelevant to the realities of today’s mobile Internet usage and experience. With news just days ago that Americans spend more time watching their smartphones than watching television, the reality is that the mobile market may have already hit an important inflection point. In the name of protecting the future, however, Europeans are living in the past.

The FTC should pay attention. Mobile is different and poised to surpass fixed Internet usage. Whatever “gatekeeper” functions Google plays on desktop PCs (which we think is a huge overstatement), it is plainly not the same in the mobile realm. Let’s free the competitive battles to flourish in mobile search before government steps in with its thumb on the scale. In a mobile world, everything is different; those differences need to and should be reflected in antitrust enforcement policies.

Note: Originally prepared for and reposted with permission of the Disruptive Competition Project.

With reality television all the rage, viewers may wonder why there’s been no reality series about the inbred high-tech ecosystem of Silicon Valley. There should be, because the reality of how our technology bastion really competes today — namely by patent litigation and acquisitions — is astonishing.

Last year Google, Apple, Intel and other leading Silicon Valley companies were targeted by federal antitrust enforcers for tacitly agreeing not to hire each other’s key employees. Such a conspiracy could have landed top executives in jail. This year Apple, Samsung, Google, Nokia and others have all been battling over back-and-forth claims that smartphones and wireless tablets infringe each others’ U.S. patents. Now, just weeks after Google’s general counsel objected that patents are gumming up innovation, the search behemoth has announced its own $12.6 billion acquisition of Motorola Mobility, and with it their own portfolio of wireless patents, just a fortnight after purchasing a relatively few (“only” 1,000 or so ) wireless patents from IBM.

While the executives at Google have nothing to fear personally from these patent wars, others seem to have a lot at risk. That is because, according to the Wall Street Journal, the U.S. Justice Department’s Antitrust Division is investigating another possible conspiracy among Silicon Valley companies. This one arises out of the collective bid in the late spring of nearly every wireless phone operating system manufacturer, except Google, for a portfolio of 6,000 cell phone patents formerly held by bankrupt Canadian company Nortel. Simply put, Google started the bidding at about $1 billion, but the others joined forces to lift the price to an astounding $4.5 billion and win the prize.

That’s the legal background to Google’s just-announced Motorola Mobility acquisition, and it’s one that could have serious anticompetitive consequences. If the curiously named “Rockstar Bidco” consortium — which includes Microsoft, Apple, RIM, EMC, Ericsson and Sony — refuses to license the erstwhile Nortel patents to Google for its Android wireless operating system, they will be agreeing as “horizontal” competitors not to deal with a rival. Classically such group boycotts are treated as a serious antitrust no-no, and a criminal offense. If the group licenses the patents, on the other hand, they could be guilty of price fixing (also a possible criminal offense), since a common royalty price was not essential to the joint bid and would eliminate competition among the members for licensing fees.

If the Rockstar Bidco companies decide to enforce the patents by bringing infringement litigation against Google, things could be even worse. Patent suits themselves, unless totally bogus, are usually protected from antitrust liability so as not to deter legitimate protection of intellectual property assets. (That does not mean they’re competitively good, since patent suits are often just a means of keeping rivals out of the marketplace.) Nonetheless, a multi-plaintiff lawsuit by common owners of patents would have those same horizontal competitors agreeing on lots of joint conduct, well beyond mere license rates. For starters, is the objective of such an initiative to kill Android by impeding its market share expansion? That’s a valid competitive strategy, standing alone, for any one company; it takes on a totally different dimension when firms collectively controlling a dominant share of the market gang up on one specific rival.

Google’s broader complaint that patent litigation in the United States is too expensive, too uncertain and too long may well be right. This bigger issue is being debated in Washington, DC as part of what insiders call “patent reform.” The high-stakes competitive battles being waged today in the wireless space under the guise of esoteric patent law issues like “anticipation” by “prior art” suggest a thoroughly Machiavellian approach to the legal process, just as war is merely diplomacy by other means. They inevitably color the perspective of policy makers, who watch with regret as a system designed to foster innovation gets progressively buried with expensive suits, devious procedural maneuvering and legalized judicial blackmail.

Even the biggest companies, though, would find it hard to compete if their largest rivals were allowed to form a members-only club around essential technologies to which only they had access. Microsoft’s own general counsel countered two weeks ago that Google was invited to join an earlier consortium bid but declined before the Nortel auction. Embarrassing, yes; dispositive, no. If the offer were still open, now that it is clear Google’s principal wireless rivals are all members, things would be different. Indeed, there’s even an opposite problem of antitrust over-inclusiveness where patents and patent pools are concerned. If everyone in an industry shares joint ownership of the same basic inventions, where’s the innovation competition? Google’s defensive purchase of Motorola is a desperate, catch-up move that does not really change this “everyone-but-Android” reality.

Silicon Valley’s patent wars are for good reason not nearly as popular as Bridezillas or So You Think You Can Dance. Yet they are far more important, economically, to Americans addicted today to their smartphones and spending hundreds of dollars monthly on wireless apps and services. Whether the Justice Department will challenge the Rockstar Bidco consortium or give it a free pass remains to be seen. From a legal perspective, it is just a shame the subject is too arcane, and certainly way too dull, to make a reality TV series.

The battle to beat Google’s Android mobile phone OS is quickly turning into a legal bonanza. Apple is suing HTC, Samsung and Motorola, all makers of wireless phones with the Android platform. Oracle is seeking up to $6.1 billion in a patent lawsuit against Google, alleging Android infringes Oracle’s Java patents. And Microsoft is suing Motorola over its Android line.

That’s all perfectly fine from an antitrust and competition standpoint — leaving aside the harder policy question of whether using patent infringement litigation to block competition should be permissible. Enforcing property rights is a legitimate and rational business activity that, absent “sham” lawsuits, is not second-guessed by antitrust enforcement agencies or courts. There can be exclusionary consequences, but they are a result of the patent laws in the first instance, not of themselves anything anticompetitive by the patent holder.

A much more troubling aspect of the increasing IP (or “IPR” as they say across the pond) battles surrounding Android is the recent sale of Nortel’s 6,000 or so wireless patents at a bankruptcy auction in Canada to a collection of bidders including Apple, Microsoft, RIM, EMC, Ericsson and Sony. How Apple Led The High-Stakes Patent Poker Win Against Google, Sealing Ballmer’s Promise | TechCrunch. The winning consortium bid more than $4.5 billion — some five times Google’s opening bid and, according to some pundits, far more than the portfolio was worth — to gain control of the patents.

“Why is the portfolio worth five times more to this group collectively than it is to Google?” said Robert Skitol, an antitrust lawyer at the Drinker Biddle firm. “Why are three horizontal competitors being allowed to collaborate and cooperate and join hands together in this, rather than competing against each other?”

Antitrust Officials Probing Sale of Patents to Google’s Rivals | Washington Post.

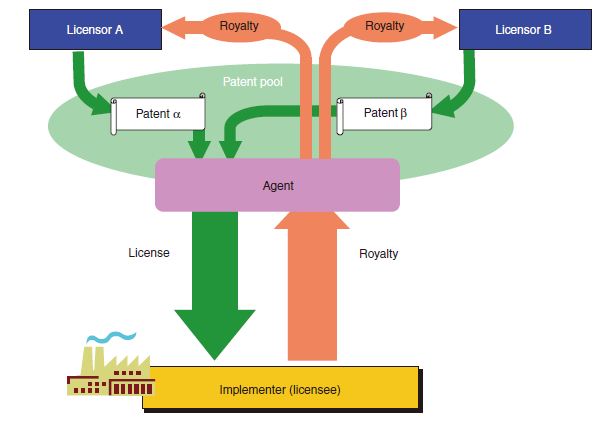

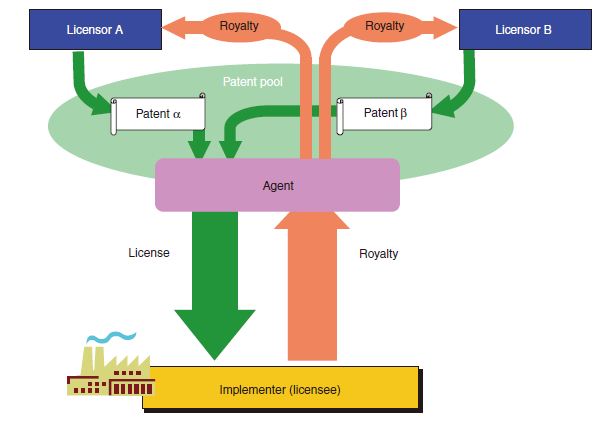

These are good questions. Patent “pools,” which are collections of horizontal competitors sharing patent licenses among themselves, are today generally considered procompetitive under the antitrust laws where they (a) are limited to technologically essential or “blocking” patents, and (b) do not contain ancillary restraints, such as resale price-setting or restrictions on participant use of alternative technologies. (MPEG, WiFi, LTE and other communications technologies are prime examples of patent pools.) The theory is that, with price effects eliminated, the cross-licensing of patents that might otherwise be used to block entry into a market reduces barriers to entry and increases efficiency.

Yet the consortium which won the Nortel wireless portfolio, revealing dubbed “Rockstar Bidco,” includes nearly everyone in the mobile phone and wireless OS businesses except Google. If these players agreed among themselves not to license their own patents to Google, that would be a per se illegal group boycott (also known as a concerted horizontal refusal to deal). Competitors cannot allocate markets or conspire to keep a rival out of the marketplace. It is unclear whether Google was invited to join Rockstar Bidco, but unless Larry, Sergey and Eric turned down such an offer, it seems a fair case can be made that the consortium bid was in effect an implicit horizontal agreement not to include Google. Post-auction, the reality of licenses will clearly tell us whether the joint ownership structure was a pretext to cover a refusal to deal. No one knows what the consortium intends to do with the Nortel patent portfolio; they won’t say. Microsoft, RIM And Partners Mum On Plans For Nortel Patents | Forbes. Yet the consortium which won the Nortel wireless portfolio, revealing dubbed “Rockstar Bidco,” includes nearly everyone in the mobile phone and wireless OS businesses except Google. If these players agreed among themselves not to license their own patents to Google, that would be a per se illegal group boycott (also known as a concerted horizontal refusal to deal). Competitors cannot allocate markets or conspire to keep a rival out of the marketplace. It is unclear whether Google was invited to join Rockstar Bidco, but unless Larry, Sergey and Eric turned down such an offer, it seems a fair case can be made that the consortium bid was in effect an implicit horizontal agreement not to include Google. Post-auction, the reality of licenses will clearly tell us whether the joint ownership structure was a pretext to cover a refusal to deal. No one knows what the consortium intends to do with the Nortel patent portfolio; they won’t say. Microsoft, RIM And Partners Mum On Plans For Nortel Patents | Forbes.

This author happens not to be a fan of Android; I’m a very happy iPhone user since day one of the Apple wireless revolution. This does not mean, though, that I can agree with a business strategy in which all of the other players in the mobile phone industry gang up on Google. (It is unclear were Nokia fits into all of this, but given the steadily decreasing share for its Symbian OS, I suspect the inclusion or not of Nokia will not be dispositive.)

The antitrust issue this presents is a thorny one, which frequently comes up in connection with trade associations and technical standards. When competitors collaborate, is under-inclusiveness or over-inclusiveness worse? Which is the bigger threat to competition? That is, if a trade group opens a collective buying consortium, for instance, is it better from an antitrust perspective to require that it be open to all — so that some rivals are not deprived of the scale economies — or that the consortium includes less than all firms in the market — so that competition in purchasing will drive down input prices?

Another concern is that, by excluding Google, the Rockstar consortium allows the other competitors to utilize the patents without paying license fees (since they now own them), leaving Google alone to need licenses for its Android OS. Does Nortel Patent Sale Make Google An Antitrust Victim? | TechFlash. That is a variant of “raising rivals’ costs” (here one rival only), which has over the past three decades become a recognized basis for assessing the anticompetitive nature of unilateral, single-firm conduct. When a group includes horizontal competitors who collectively control a huge share of the market, raising rivals’ costs supplies the anticompetitive “purpose or effect” needed to make out a rule of reason antitrust claim, even if the group boycott concern is misplaced or ameliorated. Here the intent to slow down Android is clear; whether that is anticompetitive, exclusionary or not is more ambiguous. Apple, Microsoft Patent Consortium Trying to Kill Android | eWeek.com.

There are precious few judicial decisions in this area and the IP licensing guidelines from DOJ/FTC do not really speak to the question. For that reason alone, the Rockstar Bidco venture, in my view, merits a very close look by the U.S. competition agencies. Allowing Google’s mobile phone competitors to do indirectly, with joint patent ownership, what they could not do indirectly, by agreeing not to license to Google, would be an incongruous result. On the other hand, a remedy may be worse than the harm. In standards, for example, it is often the case that antitrust risks are mitigated by requiring the holder of an essential patent to agree to so-called FRAND licensing (fair, reasonable and non-discriminatory terms and conditions). That’s an appropriate remedy where under-inclusiveness is the problem, so long as there’s a market measure for a “fair” license (royalty) price. Where the licensor, as in this instance, is everyone except the licensee, I for one fear there would be no objective way to assess whether license rates were reasonable.

DOJ's Christine Varney The lack of an effective remedy for a competition problem does not, of course, require that the transaction involved be blocked. At the same time, where a problem cannot be fixed, that is a good enforcement policy reason not to allow the structural market conditions giving rise to the issue in the first place. Put another way — a slight modification of an old aphorism — if there’s no remedy, maybe there should be no right. Whether the viability of the Rockstar consortium is decided by outgoing Assistant Attorney General Christine Varney or her September successor, the forthcoming answer should be interesting.

I’ll let my op-ed in Sunday’s San Jose Mercury News speak for itself. Opinion: In the Tech Industry, Small Isn’t Beautiful Anymore. Might be a little narcissistic to blog about one’s own article, no?

Wrangling over the proposed Google-Yahoo advertising deal makes one wonder whether scale, a virtue in Silicon Valley, can also be a vice. Some have insisted that Google is too big. But with apologies to economist E.F. Schumacher — author in 1973 of the generational anthem “Small Is Beautiful” — big isn’t bad anymore, it’s good.

A mere 10 years old, Google so dominates Internet search that the company’s name has become a verb. Google has grown large because it is good and its engineers continue to design innovative new products. That is something Web aficionados and antitrust regulators should applaud.

Google has already changed the way businesses advertise. The advertising issue is one its critics point to as evidence that Google is so large, the antitrust laws should kill the Google-Yahoo advertising venture before it launches later this month. The idea, as some ad agents have said, is that a combined Google-Yahoo share of “Internet search advertising inventory” would be competitively harmful. This is mushy reasoning being peddled to spread economic paranoia.

Everyone agrees that the principal objective of antitrust law is economic efficiency. To assess Google-Yahoo, therefore, one must first define what market we’re talking about. References to Internet search “inventory” are analytically dishonest, disguising the fact that search advertising — of which Google holds a 63 percent share — competes directly with Internet display advertising. Online display advertising is commanded by MySpace, AOL and Microsoft, and Google’s presence is tiny. As the data on rapidly declining advertising revenues for newspapers, network television and other “legacy” media reveal, Internet advertising is also becoming a substitute for advertiser dollars that used to flow elsewhere.

The consequence is that the relevant market cannot exclude Internet display advertising or even be limited to Internet advertising. And once the market covers something more than search ads, all serious competitive arguments against the Google-Yahoo transaction fade away. Take just a few.

Microsoft insists the alliance is unlawful price fixing because it will increase search advertising prices. To the contrary, neither Google nor Yahoo will be able to dictate minimum bids or prices to the other and, since advertisers will have a greater supply of more valuable search ads to buy — the demographically targeted ads produced with Google’s famously secret algorithms — the relative price for Internet search advertising will go down. That’s simple supply-and-demand, and it’s a good thing.

Others argue that Yahoo needs to remain independent and cannot be allowed into Google’s orbit. But this is not a merger or acquisition. If Yahoo’s board of directors, having just finished a bruising battle with Microsoft, violated its duty to maximize shareholder value, that is hardly the same as eliminating a competitor from the market.

Some suggest the government must act quickly to nip the growing power of Google in the bud. But in our market system we do not punish a successful company because it might do something bad in the future. Microsoft should be especially ashamed for endorsing this suggestion, since its decade-long antitrust fights here and in the EU arose from its bad acts, not its bigness. And unlike a merger, there can be no problem here of “unscrambling the egg” if things go south.

That leaves the only real objection to the Google-Yahoo! alliance as consumer privacy. There may be valid privacy objections to Google’s activities; indeed, Google might someday become so big that its possession of huge troves of personal data alone creates a threat to privacy. But as the FTC decided in approving the Google-DoubleClick merger in 2007, antitrust laws are not a substitute for privacy regulations.

So even here, privacy and bigness are not enemies. Unless Google starts acting badly in the competitive marketplace, the government should just leave it alone.

Glenn B. Manishin is an antitrust partner with Duane Morris in Washington, D.C. He was counsel for ProComp, CCIA and other software competitors challenging the Bush administration”s antitrust settlement with Microsoft. He wrote this article for the Mercury News.

Microsoft’s Steve Ballmer, once again on an anti-open source crusade, now says that Linux is a “cancer” but that the new Windows Server 2003 product can compete with free software because is it “innovative.”

Innovation is not something that is easy to do in the kind of distributed environment that the open-source/Linux world works in. I would argue that our customers have seen a lot more innovation from us than they have seen from that community. . . . Linux itself is a clone of an operating system that is 20-plus years old. That’s what it is. That is what you can get today, a clone of a 20-year-old system. I’m not saying that it doesn’t have some place for some customers, but that is not an innovative proposition.

All this from the company that brought us a desktop GUI in 2000 that Apple made available in 1987, that specializes in buying technology developed elsewhere (DOS, PowerPoint, IE, etc.) and that still cannot fugure out how to put a laptop computer to sleep. Eat your Cheerios, Steve, you’re going to need them. All you have is monopoly power; in the long-run, that’s not enough to save the company.

The Microsoft antitrust case is not over! Appeals Court to Hear Case vs. Microsoft [InfoWorld].

Well, here we go (again). I’ve been working on the Microsoft antitrust case since 1998, and now … finally … the whole thing may be coming to a resolution. Yesterday the U.S. Court of Appeals for the D.C. Circuit set the appeal by CCIA and SIIA to be heard “en banc” on an accelerated schedule. The question is whether the settlement proposed by the government and approved by a lower court is “in the public interest.” Hang on until late this year for an answer.

|

|