A sample text widget

Etiam pulvinar consectetur dolor sed malesuada. Ut convallis

euismod dolor nec pretium. Nunc ut tristique massa.

Nam sodales mi vitae dolor ullamcorper et vulputate enim accumsan.

Morbi orci magna, tincidunt vitae molestie nec, molestie at mi. Nulla nulla lorem,

suscipit in posuere in, interdum non magna.

|

Even before the landmark United States v. Microsoft Corp. antitrust case, competition law was a bit schizophrenic when it came to the question of interoperability. Monopolists have no general duty to make their products work with those of competitors, but what about the situation where a dominant firm deliberately re-designs products to render them incompatible with others? That is the provocative question raised by several pending antitrust lawsuits filed against Green Mountain Coffee, manufacturer of the Keurig line of single-serve coffee makers and coffee “pod” products.

TreeHouse Foods alleged in a complaint last winter that after its patent on “K-Cups” expired in 2012, Green Mountain:

abused its dominance in the brewer market by coercing business partners at every level of the K-Cup distribution system to enter into anticompetitive agreements intended to unlawfully maintain Green Mountain’s monopoly over the markets in which K-Cups are sold. Even in the face of these exclusionary agreements that have unreasonably restrained competition, some companies, such as TreeHouse, have fought hard to win market share away from Green Mountain on the merits by offering innovative, quality products at substantially lower prices. In response, Green Mountain has announced a new anticompetitive plan to maintain its monopoly by redesigning its brewers to lock out competitors’ products. Such lock-out technology cannot be justified based on any purported consumer benefit, and Green Mountain itself has admitted that the lock-out technology is not essential for the new brewers’ function.

In the consolidated multi-district litigation that ensued, Green Mountain is specifically charged with designing a so-called “Keurig 2.0” brewer which features technology that allows it to detect whether a coffee cartridge is one of Keurig’s K-Cups or is made by a third party that does not have a licensing agreement with the company. The machine will not brew unlicensed coffee pods.

The federal court overseeing the MDL cases denied the plaintiffs’ motion for an injunction on procedural grounds in September, issuing an opinion which reasoned that commercial success of the “2.0” brewers was uncertain and that coffee competitors would still have open access to some 26 million Keurig “1.0” machines for several years. In other words, the court did not reach the merits of the monopolization claim against Green Mountain.

So where does that leave Keurig? As Ali Sternburg observed before revelations of its new 2.0 technology, Green Mountain’s prior 20 years of patent protection allowed the company to build a competitive advantage by “cultivating its brand (which likely involves trademark protection), honing its supply chain efficiencies, and generally maintaining its dominance due to having the first-mover advantage.” More than ten years before those patents first issued, moreover, the federal courts had ruled that new product introductions by monopoly firms — in one well-known instance, Kodak — would not be considered an antitrust violation because “a firm that pioneers new technology will often introduce the first of a new product type along with related, ancillary products that can only be utilized effectively with the newly developed technology.”

Continue reading K-Cups, Innovation and Interoperability

Three high-level staffers at the Federal Trade Commission (Andy Gavil, Debbie Feinstein and Marty Gaynorare) are backing Tesla Motors Inc. in its ongoing fight to sell electric cars directly to consumers. As we’ve observed, Tesla forgoes traditional auto dealers in favor of its own retail showrooms. But that business model was recently banned by the New Jersey Motor Vehicle Commission — and is under fire in many other states as well — as a measure supposedly to protect consumers.

The ubiquitous state laws in question were originally put into place to prevent big automakers from establishing distribution monopolies that crowd out dealerships, which tend to be locally owned and family run. They were intended to promote market competition, in other words. But the FTC officials say they worry (as have we at DisCo) that the laws have instead become protectionist, walling off new innovation. “FTC staff have commented on similar efforts to bar new rivals and new business models in industries as varied as wine sales, taxis, and health care,” the officials write in their post. “How manufacturers choose to supply their products and services to consumers is just as much a function of competition as what they sell — and competition ultimately provides the best protections for consumers and the best chances for new businesses to develop and succeed. Our point has not been that new methods of sale are necessarily superior to the traditional methods — just that the determination should be made through the competitive process.” The ubiquitous state laws in question were originally put into place to prevent big automakers from establishing distribution monopolies that crowd out dealerships, which tend to be locally owned and family run. They were intended to promote market competition, in other words. But the FTC officials say they worry (as have we at DisCo) that the laws have instead become protectionist, walling off new innovation. “FTC staff have commented on similar efforts to bar new rivals and new business models in industries as varied as wine sales, taxis, and health care,” the officials write in their post. “How manufacturers choose to supply their products and services to consumers is just as much a function of competition as what they sell — and competition ultimately provides the best protections for consumers and the best chances for new businesses to develop and succeed. Our point has not been that new methods of sale are necessarily superior to the traditional methods — just that the determination should be made through the competitive process.”

As Tesla’s CEO Elon Musk noted earlier this year, “the auto dealer franchise laws were originally put in place for a just cause and are now being twisted to an unjust purpose.” Yes, indeed. It is pure rent seeking by obsolescent firms. State and local regulators have eliminated the direct purchasing option by taking steps to shelter existing middlemen from new competition. That’s not at all consumer protection, it is instead economic protectionism for a politically powerful constituency. Thanks to the FTC staff, some brave state legislators may now be emboldened to resist the temptation to decide how consumers should be permitted to buy cars.

Unfortunately, the issue is not limited to automobiles. I wrote recently about how in New York City, officials want to ban Airbnb because its apartment rental sharing service is not in compliance with hotel safety (and taxation) rules. The New York Times last Wednesday editorialized in support of that approach, arguing that Airbnb is reducing the supply of apartments and increasing rents. They’re wrong, of course, because short-term visits obviously do not substitute for years-long apartment leases. But the more important issue is that one economic problem does not justify reducing competition in a separate market. If New York actually has an apartment rent price problem, banning competition for hotels is no more a solution than prohibiting direct-to-consumer auto sales.

Originally prepared for and reposted with permission of the Disruptive Competition Project.

The strangely named Rockstar Consortium has been in the news again, in part because some of its members just formed a new lobbying group, the Partnership for American Innovation, aimed at preventing the current political furor over patent trolls from bleeding into a general overhaul of the U.S. patent system. Yet Rockstar is perhaps the most aggressive patent troll out there today. Hence the mounting pressure in Washington, DC for the Justice Department’s Antitrust Division — which signed off on the initial formation of Rockstar two years ago — to open up a formal probe into the consortium’s patent assertion activities directed against rival tech firms, principally Google, Samsung and other Android device manufacturers.

Usually the fatal defect in antitrust claims of horizontal collusion is proving that competing firms acted in parallel fashion from mutual agreement rather than independent business judgment. In the case of Rockstar — a joint venture among nearly all smartphone platform providers except Google — that problem is not present because the entity itself exists only by agreement among its owner firms. The question for U.S. antitrust enforcers is thus the traditional substantive inquiry, under Section 1 of the Sherman Act, whether Rockstar’s conduct is unreasonably restrictive of competition.

Despite its cocky moniker, Rockstar is simply a corporate patent troll hatched by Google’s rivals, who collectively spent $4.5 billion ($2.5 billion from Apple alone) in 2012 to buy a trove of wireless-related patents out of bankruptcy from Nortel, the long-defunct Canadian telecom company. It is engaged in a zero-sum game of gotcha against the Android ecosystem. As Brian Kahin explained presciently on DisCo then, Rockstar is not about making money, it’s about raising costs for rivals — making strategic use of the patent system’s problems for competitive advantage. Creating or collaborating with trolls is a new game known as privateering, which allows big producing companies to do indirectly what they cannot do directly for fear of exposure to expensive counterclaims. Essentially, it’s patent trolling gone corporate. As another pro-patent lobbying group said at the time, Rockstar represents “a perfect example of a ‘patent troll’ — they bought the patents they did not invent and do not practice; and they bought it for litigation.” Predictiv’s Jonathan Low put it quite well in his The Lowdown blog:

The Rockstar consortium, perhaps more appropriately titled “crawled out from under a rock,” is using classic patent troll tactics since their own technologies and marketing strategies have fallen short in the face of the Android emergence as a global power. Those tactics are to buy patents in hopes of finding cause, however flimsy, to charge others for alleged violations of patents bought for this purpose. Rockstar calls this “privateering” in order to distance itself from the stench of patent trolling, but there are no discernible differences.

Continue reading Rockstar’s Patent Trolling Conspiracy

Every new year sees a slew of top 5 and top 10 lists looking backwards. Here’s one that looks forward, predicting the five biggest disruptive technologies and threatened industries for 2014.

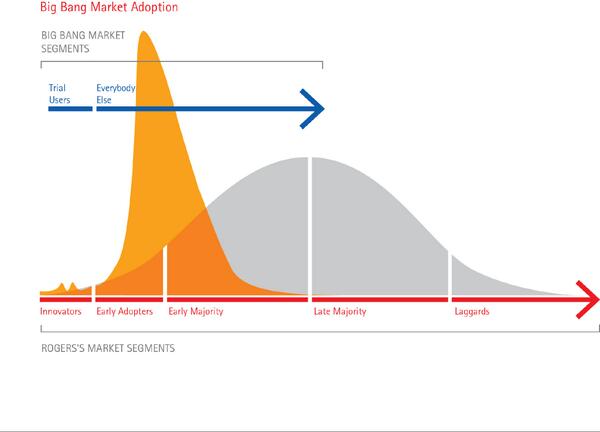

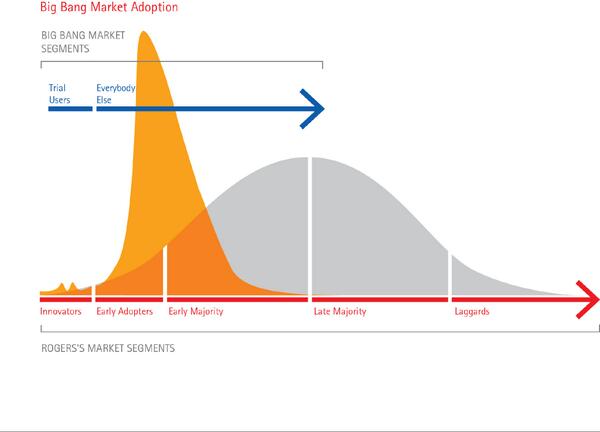

Making projections like these is really hard. Brilliant pundit Larry Downes titles his new book (co-authored with Paul Nunes) Big Bang Disruption: Strategy In an Age of Devastating Innovation. Its thesis is that with the advent of digital technology, entire product lines — indeed whole markets — can be rapidly obliterated as customers defect en masse and flock to a product that is better, cheaper, quicker, smaller, more personalized and convenient all at once.

Since adoption is increasingly all-at-once or never, saturation is reached much sooner in the life of a successful new product. So even those who launch these “Big Bang Disruptors” — new products and services that enter the market better and cheaper than established products seemingly overnight — need to prepare to scale down just as quickly as they scaled up, ready with their next disruptor (or to exit the market and take their assets to another industry).

Disruptors can come out of nowhere and happen so quickly and on such a large scale that it is hard to predict or defend against. “Sustainable advantage” is a concept alien to today’s technology markets. The reputation of the enterprise, aggregated customer bases, low-cost supply chains, access to capital and the like — all things that once gave an edge to incumbents — largely no longer exist or are equally available to far smaller upstarts. That’s extremely unsettling for business leaders because their function is no longer managing the present but inventing the future…all the time.

I certainly have no crystal ball. Yet just as makers of stand-alone vehicle GPS navigation devices were overwhelmed in 2013, suddenly and seemingly out of nowhere, by smartphone maps-app software, e.g., Google Maps, etc., so too do these iconic industries and services face a very real and immediate threat of big bang disruption this year.

Continue reading 5 Industries Facing Disruption In 2014

I’ve spent a fair amount of time at Project DisCo discussing how political, legal and regulatory processes in the United States are largely biased against disruptive innovators in favor of legacy incumbents. That’s typically just as true for Uber and its ride-hailing competitors as it is for Aereo, Hulu, Netflix and other streaming video — or over the top (“OTT”) — Internet television services. But perhaps no longer.

The Consumer Choice in Online Video Act (S.1680), introduced by Sen. Jay Rockefeller, chairman of the Senate Commerce Committee, aims to change things. The legislation’s stated objectives are to “give online video companies baseline protections so they can more effectively compete in order to bring lower prices and more choice to consumers eager for new video options” and to “prevent the anticompetitive practices that hamper the growth of online video distributors.” It does so by (a) requiring television content owners to negotiate Internet carriage arrangements with OTT providers in good faith, (b) guaranteeing such firms reasonable access to video programming by limiting the use of contractual provisions that harm the growth of online video competition, and (c) empowering the FCC to craft regulations governing the program access interface between online providers and traditional television networks and studios.

S.1680 is a remarkable legislative effort to predict where the nascent online programming market is headed. It anticipates that in order to fulfill their competitive potential, OTT video entrants will require similar legal protections to what satellite television providers have for years enjoyed. The bill applies the program access model developed several decades ago for satellite television to the new world of OTT video.

As Rockefeller explained:

[He] has watched as the Internet has revolutionized many aspects of American life, from the economy, to health care, to education. It has proven to be a disruptive and transformative technology, and it has forever changed the way Americans live their lives. Consumers now use the Internet, for example, to purchase airline tickets, to reserve rental cars and hotel rooms, to do their holiday shopping. The Internet gives consumers the ability to identify prices and choices and offers an endless supply of competitive offerings that strive to meet individual consumer’s needs.

But that type of choice — with full transparency and real competition — has not been fully realized in today’s video marketplace. Rockefeller’s bill addresses this problem by promoting that transparency and choice. It addresses the core policy question of how to nurture new technologies and services, and make sure incumbents cannot simply perpetuate the status quo of ever-increasing bills and limited choice through exercise of their market power.

Modeled explicitly on the controversial 1992 Cable Act (which itself passed only over a presidential veto), S.1680 appears to be the first piece of legislation embracing disruption as a procompetiitive form of market evolution, including as its initial congressional “finding” that OTT services have the potential to “disrupt the traditional multichannel video distribution marketplace.” That’s excellent. At the same time, the bill’s choice of solution is contentious, by subjecting vertically integrated cable and television providers (e.g., Comcast-NBCu) to another regime of program access and retransmission mandates. The legal standard fashioned for testing the validity of a television distribution contract in S.1680 is whether it “substantially deters the development of an online video distribution alternative.” Given the highly visible retransmission disputes that have arisen in recent months, such as the Tennis Channel and CBS, plus the lack of evidence that vertical integration in fact provides an incentive for exclusive dealing and content foreclosure, free market advocates are likely to object to this. Proponents of net neutrality rules, especially where data caps are concerned, have already spoken out in support.

Continue reading OTT Disruption: Is the “Rockefeller Bill” the Answer?

As a recent story from the The Washington Post illustrates well, “tradition” is a gating factor in the ongoing transformation of the legal industry. Despite the highly conservative nature of courts, bar associations and attorneys, however, in the post-Great Recession legal market of 2013, technology and changing values are rapidly disrupting traditional legal services.

My colleague and friend Jonathan Askin, Founder of the Brooklyn Law Incubator & Policy Clinic, hosted a seminar on legal start-ups in late August. Many of the companies highlighted there are focused on low-hanging fruit, taking the trend started by LegalZoom of moving do-it-yourself work product to consumers into spaces that for decades have remained buttoned-up by prohibitions against “unauthorized practice of law” and the resistance of lawyers to allowing clients document control. (LegalZoom itself has been challenged by bar groups and class action plaintiffs in North Carolina, Connecticut, Missouri and California for allegedly engaging in the practice of law, a classic and anticompetitive use of regulations designed to protect consumers, not prohibit new business models.) Like taxi-hailing companies Uber and Sidecar, legal start-ups thus face opposition from incumbents who are well-situated to employ archaic regulatory regimes to thwart new entry.

Nonetheless, the four emerging firms Askin profiled make a persuasive case that the guild-like barriers which for centuries protected lawyers from competition are breaking down before our eyes.

- Shake allows consumers to create binding contracts automatically on their smartphones or tablets with a few Q&As and then sign them electronically.

- Lawdingo leverages the power of networking to connect consumers to lawyers for real-time quick (and often free) answers on a virtually unlimited number of topics.

- Caserails offers cloud-based document assembly and editing functionalities for individuals or groups, long the bane of corporate transactions.

- Priori Legal allows SMBs to select among a trusted community of lawyers for discounted or fixed-rate engagements with Web-based comparison shopping.

The best and brightest of these firms will undoubtedly rise to the top over time. Much like banks in the 1970s — when toasters as deposit “gifts” were replaced by deregulated interest rates and tellers by ATMs — legal consumers no longer care or very much appreciate the old traditions of the legal profession, especially its convoluted language, fancy office space and expensive artwork. The successful start-ups in this steady disintermediation of legal services will be the ones who recognize that they are driven by what legal transactions can and will be, not what they have been historically, and that they are technology companies solving legal problems, not legal companies trying to understand technology. Continue reading Disrupting the Legal Industry

The U.S. economy has seen its share of disruptive technologies derailed (at least in time-to-market) by archaic legal regimes. Look to Uber’s taxi-hailing service and Airbnb’s apartment rental innovations as recent examples. Most times it’s a case of old assumptions about consumer protection and competition having lost validity with changed circumstances. Other times it’s simple protectionism by legacy incumbents, as in the legal assault on Aereo’s IPTV streaming service for alleged copyright infringement. In the case of electric auto developer Telsa Motors, however, it’s something a little different.

The problem for Tesla’s well-reviewed vehicles — Consumer Reports gave the new Tesla S its highest car rating ever — is not technical, as the California start-up boasts impressive lithium battery innovations and is aggressively building its own chain of recharging stations. Instead the constraint is a plethora of state laws (48 in all) that prohibit or limit automobile manufacturers from selling direct to consumers or owning auto dealerships. These statutes, which date to the 1950s, are matched by a federal law known as the “Automobile Dealers’ Day In Court Act.” That legislation is an anomaly which allows dealers (franchisees) to sue in their home federal district court and recover legal fees if a manufacturer fails to “act in good faith in performing or complying with any of the terms or provisions of the franchise, or in terminating, canceling or not renewing the franchise with said dealer.” (These sorts of lawsuits would otherwise require a minimum of $75,000 at stake, would be governed by state law and would not have the threat of fee-shifting.) The problem for Tesla’s well-reviewed vehicles — Consumer Reports gave the new Tesla S its highest car rating ever — is not technical, as the California start-up boasts impressive lithium battery innovations and is aggressively building its own chain of recharging stations. Instead the constraint is a plethora of state laws (48 in all) that prohibit or limit automobile manufacturers from selling direct to consumers or owning auto dealerships. These statutes, which date to the 1950s, are matched by a federal law known as the “Automobile Dealers’ Day In Court Act.” That legislation is an anomaly which allows dealers (franchisees) to sue in their home federal district court and recover legal fees if a manufacturer fails to “act in good faith in performing or complying with any of the terms or provisions of the franchise, or in terminating, canceling or not renewing the franchise with said dealer.” (These sorts of lawsuits would otherwise require a minimum of $75,000 at stake, would be governed by state law and would not have the threat of fee-shifting.)

Continue reading Want A Tesla? You Can’t Buy One Here.

Tech business news these days is dominated by headlines about the trial of United States v. Apple, Inc., where the U.S. Department of Justice (DOJ) is charging Cupertino with masterminding a massive conspiracy among publishers to increase prices for e-books. Apple’s defense lawyers and CEO Tim Cook call the allegations “bizarre.” What is really bizarre, though, is the plethora of private treble-damages lawsuits seeking to hold Apple liable under the antitrust laws for its vertical integration strategy with iTunes, iPhone and the App Store.

Just a bit more than a decade ago, Apple Computer (having since changed its corporate name) was decidedly stuck in the backwater of the PC industry. Its introduction of the USB-only iMac in 1998 failed to change the marketplace dynamics, where Apple’s closed Macintosh design and refusal to license its Mac OS to other manufacturers was viewed as the source of diminishing relevance. Apple was such a non-entity that its presence was flatly rejected by the federal courts as part of the relevant market in the Microsoft monopolization cases. Pundits predicted that like the fabled Betamax, Apple’s proprietary strategy would lead to its ultimate competitive demise.

But then along came the “iLife” software suite and the first generation iPod. What differentiated these products was not that Apple invented the technologies — after all, MP3s had been around for years and digital cameras as well — but rather that they all worked well together. Since then, the same business model has been applied to iPads and iPhones: native sync integrated with the Mac OS and Apple’s iCloud service, plus software content, whether media or apps, available easily through Apple’s online stores, with the company taking a 30% cut of retail prices for third-party content.

When the iPod and iPhone proved to be winners, big ones, Apple’s financial fortunes turned around dramatically. iTunes now is the largest digital music retailer, accounting for some 60% of all downloads, and the various iPhones are the most popular smartphones globally. Apple’s annual revenues soared from $5 billion in 2001 to $108 billion last year. But what short memories we have. The plaintiffs’ antitrust bar accuses Apple of unlawfully monopolizing these markets and has filed a series of sometimes confusing consumer class actions challenging Apple’s vertical integration and closed product systems. (Nine separate lawsuits have been unified into one action in California focusing on the tight grip Apple exerts on the iPhone’s services and applications; other individual and class suits are pending elsewhere.) The EU reportedly has investigated Apple’s App Store restrictions, and more recently its deals with European wireless carriers, to determine whether the company “abused” a “dominant position.” When the iPod and iPhone proved to be winners, big ones, Apple’s financial fortunes turned around dramatically. iTunes now is the largest digital music retailer, accounting for some 60% of all downloads, and the various iPhones are the most popular smartphones globally. Apple’s annual revenues soared from $5 billion in 2001 to $108 billion last year. But what short memories we have. The plaintiffs’ antitrust bar accuses Apple of unlawfully monopolizing these markets and has filed a series of sometimes confusing consumer class actions challenging Apple’s vertical integration and closed product systems. (Nine separate lawsuits have been unified into one action in California focusing on the tight grip Apple exerts on the iPhone’s services and applications; other individual and class suits are pending elsewhere.) The EU reportedly has investigated Apple’s App Store restrictions, and more recently its deals with European wireless carriers, to determine whether the company “abused” a “dominant position.”

Continue reading Five Reasons Apple’s Private Antitrust Risks Are Minimal

In a post about Twitter several weeks back, I concluded that “[a] threat of government action can be just as debilitating to innovation as premature enforcement intervention into the marketplace.” Although the subject then was vertical integration, the same is true of broader antitrust issues, like mergers, and tech policy issues such as privacy. When the rules are ambiguous, and enforcement discretion allows for a wide range of subjective governmental decisions, uncertainty breeds business timidity because rivals can game the process.

A Wall Street Journal opinion piece by L. Gordon Crovitz on Monday made this same point. Commenting that Google’s proposed acquisition of travel guide publisher Frommer’s could disrupt the travel market even further (as Dan also covered on DisCo) — and reacting to all-too-typical calls by Google’s competitors for “close” Federal Trade Commission review of the deal — Crovitz wrote:

As a regulatory matter, there is real risk that the current antitrust review by the FTC will block innovation in the search industry. The agency could freeze Google into its historic way of doing business by stopping it from delivering answers directly (removing the consumer benefit) and by banning acquisitions such as Frommer’s…. For the technology companies that are supposed to be the drivers of our economy, this kind of regulatory uncertainty is a growing burden. The response to innovation by one company should be more innovation by others, not competitors calling in lawyers and lobbyists.

The FTC’s Threat to Web Consumers | WSJ.com.

Could not have said it better myself!

Note: Originally prepared for and reposted with permission of the Disruptive Competition Project.

With calls for elimination of the U.S. penny going back decades, we are now on the verge of an inflection point for commercial payments. Between debit cards and emerging mobile payment systems, it seems innovation can disrupt even established roles of government that date to the U.S. Constitution (1789) and centuries beforehand.

Cash moved one small step nearer to its deathbed with the announcement on Wednesday that Square, the mobile payments start-up, would partner with Starbucks Coffee Company, reports Claire Cain Miller on Wednesday in The New York Times.

Daily Report: A Step Forward for the Mobile Wallet.

Social security checks are today almost completely a thing of the past. How many more years or decades before currency itself becomes extinct? And will this sea of change also disintermediate banks? Wait and see, but likely not for long.

Note: Originally prepared for and reposted with permission of the Disruptive Competition Project.

|

|